I’m selling a motorbike and have interest from someone from abroad, they seem to think that I can just fill in section 11 of the V5C, and send it to DVLA and all is good, I think that I need to transfer ownership first so that they can fill in section 11, anyone got any experience of this?

The number of scammers involved in remote sales and purchase I would be suspect of any foreign transaction.

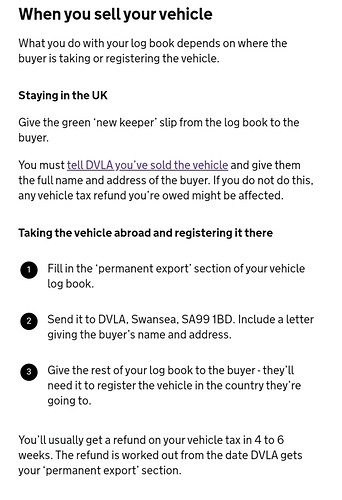

From the GOV.UK Q&A

Taking the vehicle abroad and registering it there

- Fill in the ‘permanent export’ section of your vehicle log book.

- Send it to DVLA, Swansea, SA99 1BD. Include a letter giving the buyer’s name and address.

- Give the rest of your log book to the buyer - they’ll need it to register the vehicle in the country they’re going to.

You’ll usually get a refund on your vehicle tax in 4 to 6 weeks. The refund is worked out from the date DVLA gets your ‘permanent export’ section.

=============================================

Receiving money . In order to receive money from overseas , you will need to give the sender the details of your bank account and your BIC/Swift Code which you can get from your bank. You will also need to provide your Bank State Branch (BSB) along with your account number, full name and street address.

This all makes no sense to me, how do I know the buyer actually exported it? Section 11 says Personally exporting…

I am, I have no issue with the transaction if the courier turns up with cash, but the DVLA stuff has to be right…

I sold a motorbike to someone in 2017 who said they were trailering it to Poland. I kept waiting for the DVLA to come back tow telling me I’d be scammed but the transaction seemed to be ok in the end.

You will need to get copies of the new owners driving licence, car insturance and depending of country car going to completed forms of sale. Use a bank transfer only never cash in hand and allow 3 /4 days for bank transfer to clear (it does this within minutes, but they can withdraw the bank transfer up to 24hrs after making it)

Like others, I would be careful of this buyer as they should provide you with all the above.

Hi Robbie,

I have found this a complicated area, and have spoken to the DVLA regarding the issue. All they will say is the inf quoted by Jingars above.

I have exported over 25 vehicles to France from the UK over the last fifteen years.

I live in France. When I source and buy a vehicle in the UK I use my parents address as a contact address in the UK, therefore getting a UK V5 in my name.

When I register the vehicle here, I send off the “exported” section of the V5 to Swansea.

However you have to pay a substantial fee here to get a “carte gris” ( French V5 ) based on the horsepower of the vehicle. This happens everytime the vehicle changes hands. So if I register it, then sell it on, the new owner pays the same fee ( or perhaps slightly more or less if they live in a different region ) a few weeks after I have paid the fee, great tax revenue generator! For example an early MX5 is around €200 euros, an early Jaguar XKR €800 euros. For newer or poluting cars the fees are much higher.

So selling the vehicle on UK plates makes financial sense.

However certaily here in France, there is a lot of French paperwork to complete. One of these forms is a “certificate of cessation”, which includes the details of the buyer / seller, numbers from a piece of ID ( passport, National ID card Drivers licence etc ) , date and time of sale. After I raise this form, along with several others, I am happy to just post the " exported" slip of the V5 off, and I have fulfilled my obligations, but also have proof that the vehicle has been sold on.

You could ask your potential purchaser to furnish to you simalar documents from their country. I feel this would exhonerate you if there were any problems in the future.

However, as others and yourself have expressed doubts regarding the authencicity of the transaction, I will add my tuppence.

I do not know which country the buyer is from, but its a bike you are selling. Unless the bike is very rare in the buyers country, he / she will most likley incurr huge expense registering it in their country.

Here in France, the headlight and speedo would have to be inspected by a main dealer as there is no equivelent MOT for bikes. If the spedo has MPH on the outside and KPH on the inside, the spedo will ahve to be changed ( unless it is digital and can be changed from one to the other.) If the headlamp has a beam pattern, that will have to be changed, both by the main dealer, who will supply an assestation to say they have been changed to LHD secifications. The buyer will need to supply a certificate of conformity during the registration process. They can be difficult to obtain and take a while from most manufacturers ( Mazda being in my experience one of the fastest and cheapest, £85, however Jaguar / Landrover over 3 months £150 + coppies of driving licence, passport, V5, Vin nos, photos of steering wheel etc ).

Then you scan all the paperwork, send it off electronicaly, and hope you have everything you need ( Oh I forgot to say that you need a declaration from the tax office, which you have to get in person from the head tax office which is an hour and a half each way for us! You will pay import tax if the vehicle is less than 6 months old or 6000km on the clock).

You then finaly get the green light, pay the appropriate registation fee, and get a carte gris ( V5) in your name. You then spend more money on new numberplates which have to be rivited to the vehicle.

So in summary, not an easy or cheap road to take. Things will become harder after 31st December when the import rules will change, and I suspect all imoprts from outside the Eu will attract the 20% + VAT import charge.

Its a hard decission for you in these difficult selling times, but unless your buyer can supply you with a legit UK address to use for V5 purposes, I would be tempted to wait for a different buyer to come along…as an asside, I don’t know the limit on cash transactions in the UK, but here its €3000 …big brother is watching !

Good luck

Richard

Did you send section 11 of the V5C along with a covering letter to DVLA with the buyers address abroad and give the remainder of the V5C to the buyer? Did you get an acknowledgement from DVLA?