Having to go to the post office earlier for something else, and as of yet not receiving my ND’s tax reminder letter, and not wanting to do it online and give bank details, I took my V5C to the post office thinking I could just tax it that way. The woman in the post office said she could of course tax it ‘via the V5C’, but it’ll go from the beginning of the month (july), when it’s actually due for the start of August. She said the only way you can ‘forward do it’ is via the reminder form. She said if you want to do it by the V5C and keep the August date, she said you’d have to do it on the 1st August. I said technically the car wouldn’t be taxed temporarily then though, as past midnight on Aug1st last year’s tax will have expired, so if it was on the road it wouldn’t be taxed until the post office opened. She said yes.

Q: Is she guessing or actually giving correct info?

I would say technically she would be correct, not 100% on that though.

Just a scenario, if you had an accident (police/insurance involved etc) at say 00.30 hrs on August 1st and it was found you aren’t taxed… explaining… but officer I was going to do it in the morning when the PO opened.

I guess your tax reminder is imminent, surprised you haven’t had it by now.

Ok it’s easy to just tax online, your choice of course. It’s an a**** that mid month you have to go from the start of the month, it’s mostly been that way though👎

It sounds correct to me. The post office would also need to see a valid MOT certificate.

Cheers. Yes, I didn’t want to risk doing it when she said that, given it’s still taxed until Aug 1st.

I presume if you do it online it goes FROM when it expires, i.e Aug 1st and not back to July the 1st?

They don’t need to see one when I just given them the reminder form though, which is the way I’ve only ever payed for car tax? I once asked would he (the post office guy) know if it didn’t have a valid MOT, and he said yes, it’d flag up on his screen.

As she explained, with the reminder it’ll get done from 1st August.

I’ve just done this too from June, memory says, if you use the V5 to tax the car inputting the numbers on that it always goes to the start of the month you are in, even online.

Cheers.

If the reminder don’t turn up it’ll be 1st August then. The car is on the drive anyway.

Good info. Thanks again to both of you ![]()

The last time I taxed my car at a post office they needed to see my MOT, but that was a very very long time ago🤔.

Nowadays I always do both cars on line as soon as the reminder arrives and it starts from the following month.

I do my vehicles by direct debit, that way i never have to give it a second thought.

I started taxing online when seeing the queue at the PO on car taxing day, 1st of the month. Also the postmaster was becoming such an a**** with it all, you ain’t done this and that on the form, not me the others in the queue. That was a good few years ago, had enough, don’t know why I didn’t do it years before .

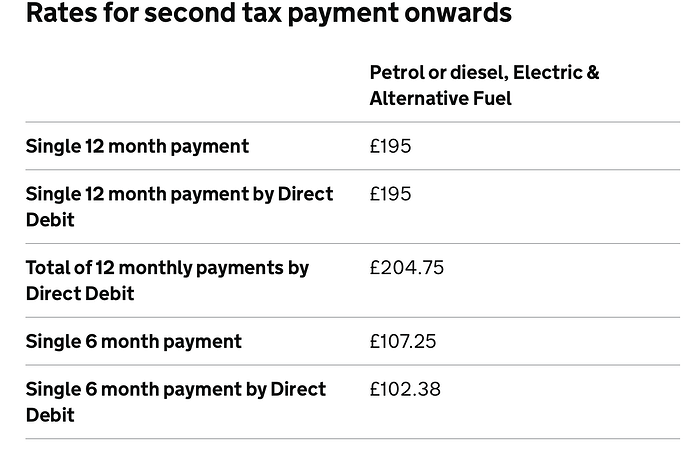

I assume you can set this up annually so there is no 5% surcharge.

I’ve never thought about doing it this way so will probably swap to DD next time round.

I could be wrong here, but i think if you are paying by DD there is no surcharge whether it’s monthly, quarterly or yearly. ![]()

The only thing that somebody can do with your account number and sort code is pay money in to your account, so I’m not sure why you’re reluctant to do this.

I don’t miss having to go to the post office to renew car tax, remember doing it in the 90’s, and it was a pain.

Just checked on Gov website, there is a surcharge for everything except annual payments. Will be setting my single 12 month DD up in Nov - thanks for the heads up. ![]()

That will teach me to keep a closer eye on things. ![]()

Because it’s not hard to walk to the post office and do it.

Update on this:

If you do it by inputting the V5C doc ref number on the Gov’t website (i.e after ticking ‘no’ to have the question ‘have you a V11 reminder form’), it DOES do it from the anniversary date (in my case, August). I haven’t paid it (I’ll wait and see if the reminder comes), but I went ‘through’ it and it said the car will be taxed from 1st Aug, 2025, not back to the start of this month. I just closed it up before I got to the pay window.

Looking at a section on paying tax when one is abroad etc, it says something about doing it after the 5th of the month before it’s due. Maybe it allows you to keep the anniversary if you do it after the 5th.

I think without the reminder you have to wait until closer to the expiry date to do it. I seem to remember 14 days before is the earliest you can do it. Maybe try the Post Office again closer to the expiry date if that is the way you want to do it.

Given it would let me keep the anniversary now if I did online now (see above post, I just did a dummy run), it’d ‘probably’ be the same for a hard copy V5C at a post office. But given there’s no way of checking before paying like you can online (except maybe calling the DVLA office), I wouldn’t risk it. If it don’t arrive by late month I’ll just have to do it online.

Cheers anyway ![]()